Netflix-Binge watch together

- Harsh Mittal

- Dec 20, 2021

- 3 min read

Netflix is an American multinational subscription streaming service that provides access to digital content throughout the world.It was founded by Reed Hastings and Marc Randolph on 29 August 1997 out of Scotts Valley , California.They are a true silicon valley startup founded to solve a prominent issue of bulky cassettes for movie rentals.They originally worked with the same model but later moved to providing media services online after the widespread use of the internet.Netflix went public on May 29, 2002 with 5.5M shares hitting the capital markets at 15$ per share.

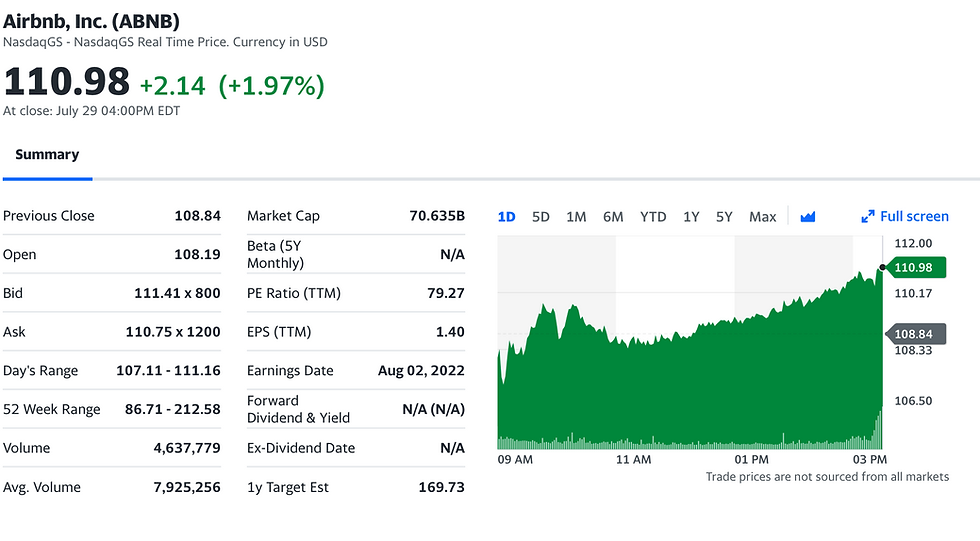

Netflix currently trades at 590-595$ with a market cap of 265B $.They have created remarkable progress and expansion in essentially 20 years.The greatest blessing would have been the rise of the Internet and the widespread usage of WiFi and telecom services.Netflix has always stayed profitable which is rather unconventional for similar silicon valley giants in the first years of operation.Recently they have expanded to production studios which has allowed release of original media popularly known as the Netflix Originals.

Netflix has a price forecast of 705$ with a high prediction of 800$ and a low estimate of 342$.The median price represents a 20% increase from the last trading price which implies growth potential but with varying forecasts there is also a factor of extreme volatility noticed.The company is under oligopolistic competition and has also seen takeover interest from another well established technology giant Apple.Analysts predict a heavy fall in price in this market correction but still suggest buying for investment horizons ranging from 1-5 years.

Netflix is the largest steaming service by revenue and customer volume.They also have twice the media of any completing company and are present in more than 125 countries officially.They produced more than 3000 minutes of media in the first half of 2021 which is tremendous in comparison to similar producers.They have also been the first major streaming service which has really allowed them to capture a sizeable market share and become profitable.The biggest edge they have over their competition is recurring revenue and consumer loyalty.Their business models takes use of various models such as the subscription and data selling model which allows for super normal profits.Following the release of the world famous show Squid Games and the Umbrella Academy, they are capturing market share from their competitors.Speaking of competitors, they are facing heavy competition in the American market and also globally.With aggressive growth policies of Amazon’s streaming service Prime Video , they seem to be losing or sharing consumers in the industry.Prime video recently announced their ties with lionsgate and HBO to provide services to Prime users.This makes the Prime subscription an extremely profitable service to any average consumer but at the end of the day they lack the Netflix Originals. Netflix has also been criticised heavily and even banned in certain parts of the world for their objectionable content.Certain documentaries are banned in specific regions citing religious and societal causes but there are certain countries where they are deemed illegal and objectionable to view.This censorship issue is a major hurdle for Netflix and other OTT platforms to overcome while still maintaining all forms and genres of media.All in all, Netflix is going in the right direction but has much competition local and international.The pandemic has created a massive inflow of consumers to the OTT industry which has majorly benefitted Netflix.The recurring revenue is another positive sign for the brand.These factors deem Netflix to be a profitable stock among investors and retail traders.

Comments